how to get amazon flex tax form

Adjust your work not your life. Turn to podcasts for company.

Amazon Flex Debit Card How To Apply For And Use The Card

You can get an Amazon Flex pay stub in one of three ways.

. If you receive income from Amazon Flex you must file your taxes as an independent. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. Whatever drives you get closer to your goals with Amazon Flex.

We know how valuable your time is. Pick up packages from an Amazon delivery station and deliver directly to customersDelivery blocks are typically 3-6. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year.

Gig Economy Masters Course. Use the Amazon Flex app. Amazon Flex offers these delivery opportunities.

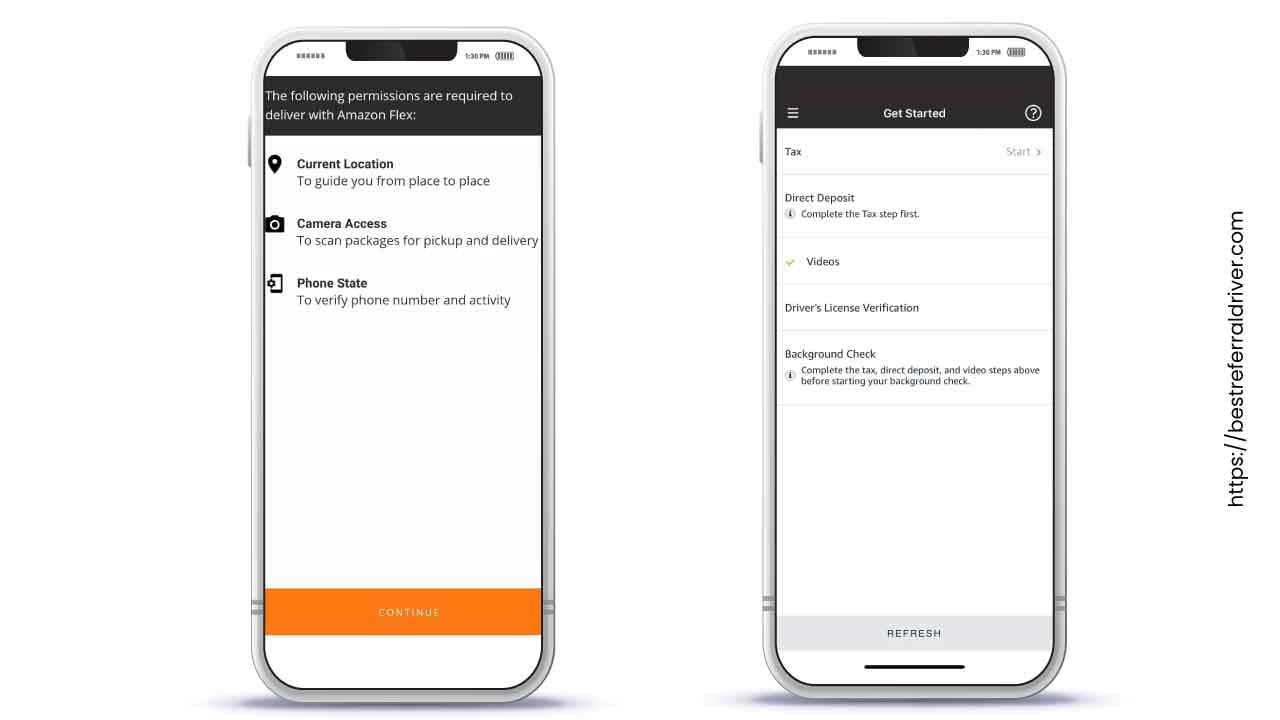

Keep your app updated to the latest version. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your. With Amazon Flex you work only when you want to.

Sign in using the email and password associated with your account. Amazon Flex will not withhold income tax or file my taxes for me. Click Download to download.

So if you drive for Amazon Flex and are unclear about your taxpayer status or responsibilities -- and how the 1099 form figures into it all -- the following information should answer a few. Keep track of what you spend on Amazon Flex. Increase Your Earnings.

Stack Amazon Flex with other delivery apps. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. If youre using the app to drive for Amazon Flex you can see all your earnings including.

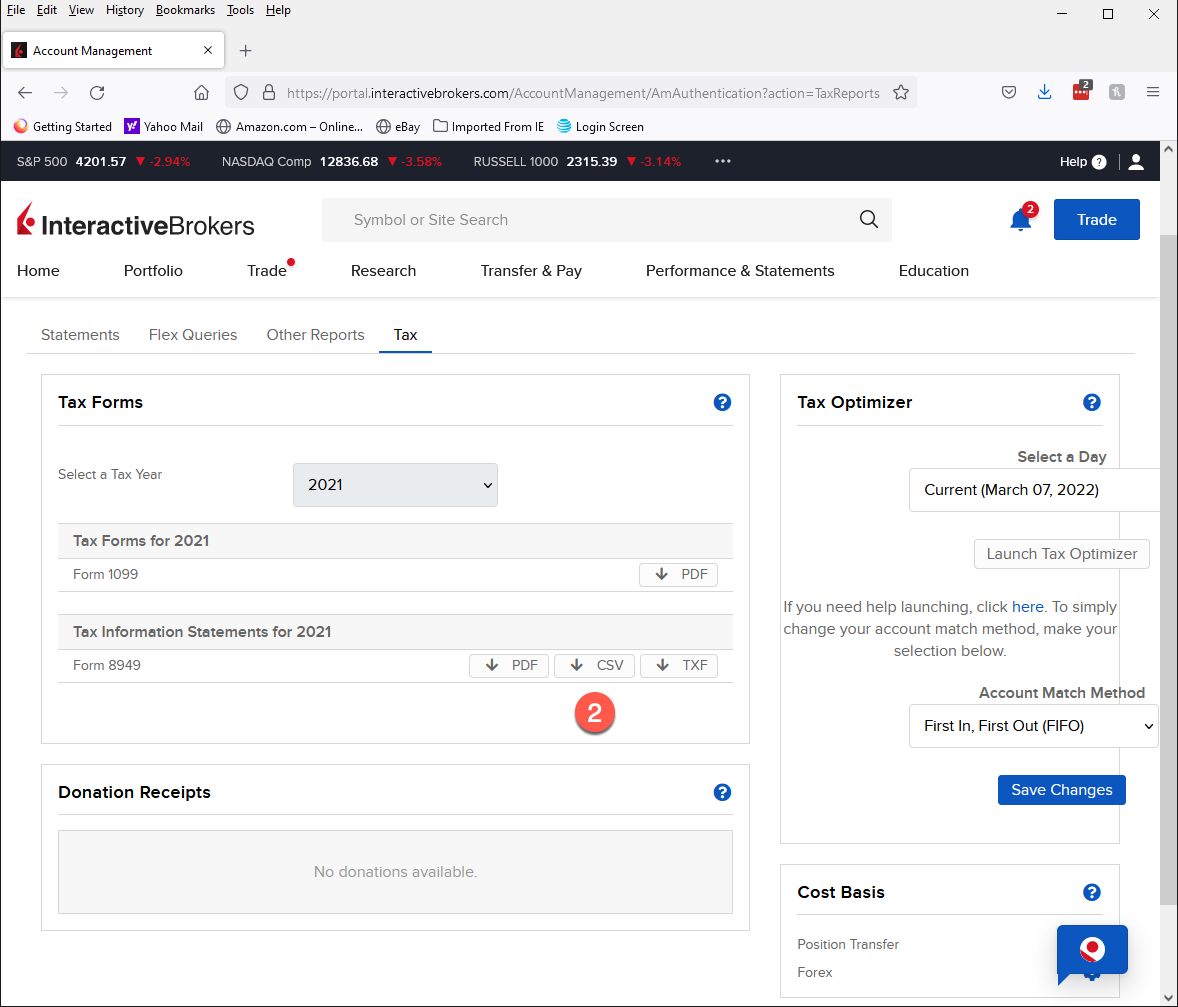

The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or. This means that you must complete Schedule C and attach it to Form 1040 the standard tax return. Click ViewEdit and then click Find Forms.

How To Apply For Amazon Flex Driver Jobs Career Info

How To Become An Amazon Flex Driver Hyrecar

All About Amazon Flex Driver In Australia Requirements Pay Rate Registration And More

Simon Kwok Ridesharedash Twitter

Tax Deductions For Uber Lyft And Amazon Flex Drivers How To File The Perfect Tax Return Youtube

Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Online Generation Of Schedule D And Form 8949 For Clients Of Interactive Brokers

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

All About Amazon Flex Driver In Australia Requirements Pay Rate Registration And More

Amazon Flex Delivery Drivers Tell Of Insecurity Low Pay And Safety Concerns In Uber For Parcels Scheme Abc News

How To File Amazon Flex 1099 Taxes The Easy Way

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels